April 18, 2023

We spent the last two posts diving into Andy Warhol Foundation for the Visual Arts, Inc. v. Goldsmith and some of the cases leading up to it. You can read those posts here and here.

Now, let’s turn to the oral argument before the Supreme Court and the Justices’ questions for the parties in that case.

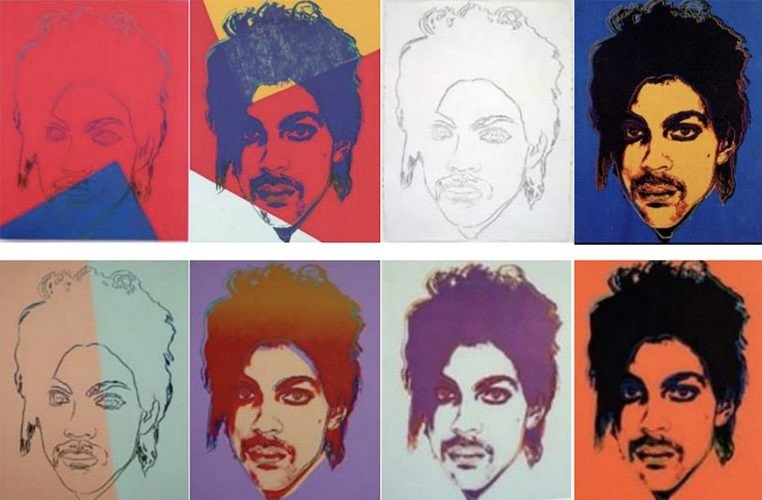

As the appellant, the Warhol Foundation went first. Its central argument was that Warhol’s changes to Lynn Goldsmith’s photo of Prince gave Warhol’s work a different meaning or message. Specifically, its lawyer argued that Goldsmith’s photo is a photorealistic portrait of Prince while Warhol’s work is a depiction of the dehumanizing effects of celebrity. Based on this, according to the Foundation, Warhol’s Prince Series made fair use of Goldsmith’s photo.

The Justices had some doubts. They wanted to know how a court should determine whether new work has a sufficiently distinct meaning or message to qualify for fair use. The Foundation responded that Courts could look at a range of things in determining the meaning and message of a given artwork including: (1) evidence from the creators; (2) expert testimony; and (3) the judges own impressions. Justice Alito, however, noted that it could be hard to figure out what “meaning or message” to pay attention to because people might see things not intended by the artist.

The Foundation also faced questions about how to square its position with the fact that copyright law gives the right to create derivative works to the original artist — in this case, Goldsmith. (A derivative work is an adaptation of the original, for example, a translation of or a film made from a book.) In line with this, the Justices wanted to know whether a second artist performing another artist’s song in a way that conveys a different meaning is enough to avoid a claim of copyright infringement. The Foundation responded that it would require looking at other fair use factors. For example, whether the second work competed with the original.

Here, Justice Sotomayor pointed out (rightly) that this pretty much destroyed the Foundation’s argument as the Prince Series definitely competed with Goldsmith’s photograph as an illustration for an article about Prince’s life. The Foundation tried to avoid this by arguing that Goldsmith’s photo and the Prince Series had different audiences (and, compared to Goldsmith’s photos, the Prince Series fetched, um, princely sums).

Goldsmith’s attorney faced the Justices next. Among other things, she argued that a party claiming fair use should have to show that it needed to use the original work. In response, the Justices wanted to know the source for the test she was proposing. Goldsmith’s attorney responded that it came from the Supreme Court’s decision in Campbell. Justice Kagan was skeptical though. She noted that Campbell didn’t actually say that. Rather, it says that “if you need the original work, that’s the paradigmatic case.” Justice Kagan also noted that even if the second creator didn’t “need” the original work, there are plenty of situations where the new work is sufficiently transformative to be fair use. By way of example, Justice Kagan noted that Campbell uses “Warhol as an example of how somebody can take an original work and make it be something entirely different and that’s exactly what the fair use doctrine wants to protect.”

Goldsmith’s attorney also noted movie, music, and publishing industry groups supported Goldsmith’s position and were “horrified” by the Warhol Foundation’s position because it would essentially eliminate the right to control derivative works as set forth in the Copyright Act. She pointed out that the Warhol Foundation’s position would allow someone to create a movie where Darth Vader is a hero, not a villain, and claim fair use.

Finally, the Court heard from the United States government. It argued that the Court should not focus on a work’s meaning or message because it would destabilize long-established licensing markets, which have worked just fine in creating new and derivative works. It also argued that the Court should consider whether the second use has a distinct purpose or does it supersede the original, and, also, what is the justification for copying.

According to the US, both of these factors point against a finding of fair use in this case because the Foundation has never tried to show that Warhol’s copying of Goldsmith’s photo was essential to accomplish a new or distinct purpose. Put another way, the government argues that you can’t use another artist’s work to directly compete with that artist’s work unless there’s a justification for the copying.

Stay tuned. We should have a decision soon.

April 4, 2023

The U.S. Supreme Court should issue a ruling soon in Andy Warhol Foundation for the Visual Arts, Inc. v. Goldsmith. This is the latest Supreme Court case to examine copyright law and the doctrine of fair use which, together, are supposed to both encourage the creation of art by ensuring creators own (and are paid for) their work while also allowing others to use existing works to create new ones. The stakes are high because the potential creative and financial ramifications are huge.

Following up on the previous blog post: how did it all come to this?

The most straightforward answer is that we got here by judges (trying) to make principled decisions about when borrowing is fair use and when it’s infringement. With visual art, to put it mildly, this is tricky.

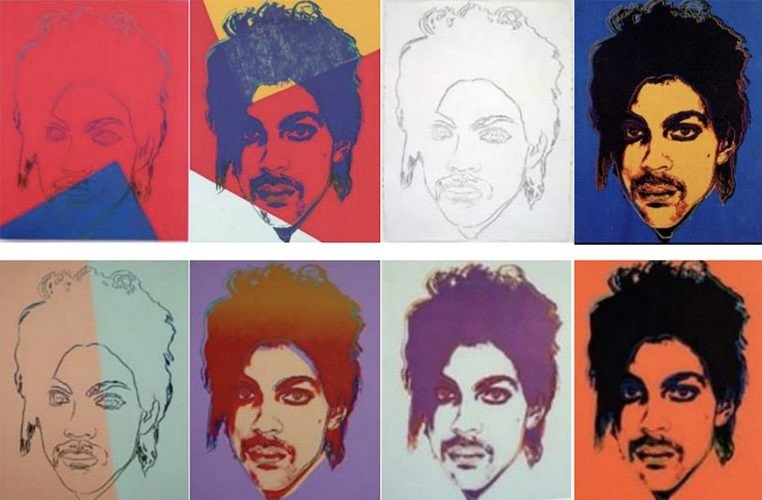

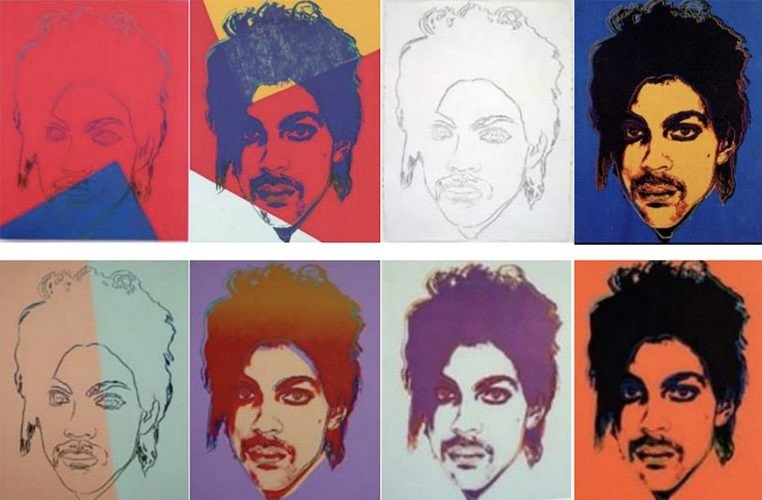

By way of example, according to the Second Circuit, this:

is fair use of these:

but, these:

which incorporate this,

are not.

The first set of images comes from Cariou v. Prince, a case in which photographer Patrick Cariou sued “appropriation” artist Richard Prince over 30 artworks Prince created that included elements of Cariou’s photos of Rastafarians. The Southern District of New York ruled in favor of Cariou, holding that Prince’s works were not fair use because they didn’t comment on or criticize Cariou’s photos.

The Second Circuit disagreed. It found that the District Court imposed an incorrect legal standard by requiring Prince’s work to comment on Cariou’s work.

Instead, the Second Circuit emphasized that to constitute fair use, the later work must “alter the original with “new expression, meaning or message.” The Second Circuit took this standard from a 1994 Supreme Court case, Campbell v. Acuff-Rose Music, Inc., which involved 2 Live Crew’s adaptation of Roy Orbison’s song “Pretty Woman.” In particular, the Second Circuit held that Prince’s artworks had an “entirely different aesthetic from Cariou’s photographs.” Based on this, the Second Circuit concluded that 25 of Prince’s artworks were sufficiently transformative to constitute fair use (the question of the remaining five works was remanded to the District Court).

In reaching this conclusion, the Second Circuit said that it shouldn’t be read to suggest that any cosmetic changes are enough to mean that something is fair use. Rather, it emphasized the fact that Prince’s images had “a fundamentally different aesthetic” than Cariou’s photos.

While that certainly appears to be true in Cariou, it also may be true in Warhol v. Goldsmith — as the Warhol Foundation has argued — that the Prince Series has a very different aesthetic from Goldsmith’s portrait of Prince. But how do artists (or lawyers or judges) determine how much transformation is enough to put them in the clear? Is it possible to predict how a court will balance the elements that go into a fair use analysis? Is there a way to define or measure exactly how much of a different aesthetic is required? Moreover, when is a secondary use “derivative,” meaning that the original owner controls the right to make additional works, and when is it fair use?

More on this next time.

March 21, 2023

U.S. law has long grappled with when it’s okay to copy someone else’s work. This is a central tension of copyright law, which is supposed to encourage people to create by ensuring they can get paid for their creations while also allowing others to base new works off of existing ones.

These dueling forces are the subject of the legal doctrine of “fair use,” which is at the heart of a case the U.S. Supreme Court will soon decide. The case, Andy Warhol Foundation for the Visual Arts, Inc. v. Goldsmith, is being closely watched by artists, collectors and museums.

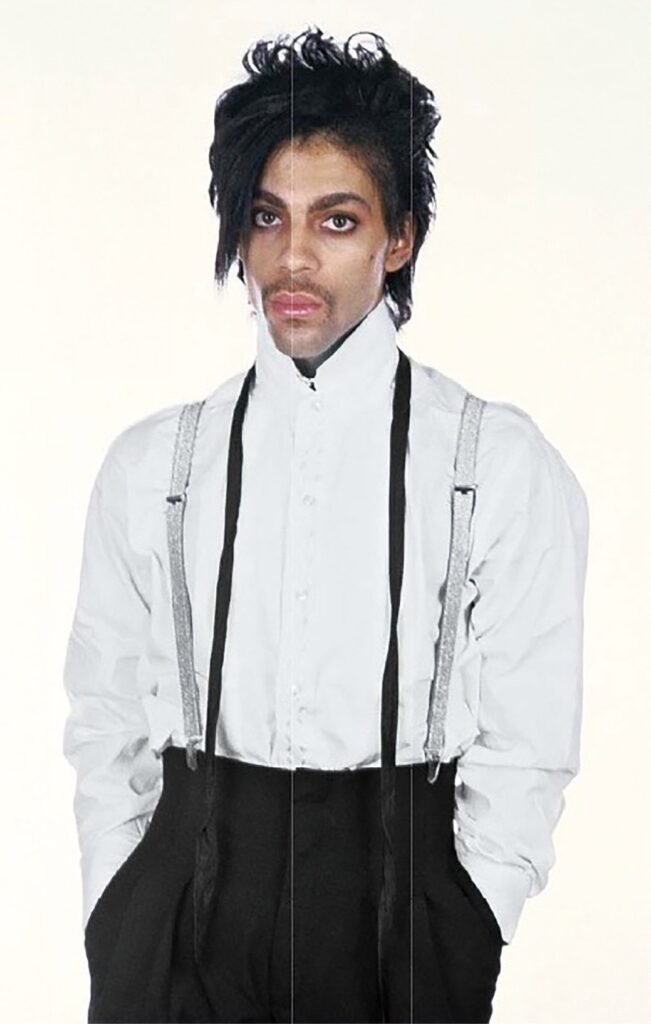

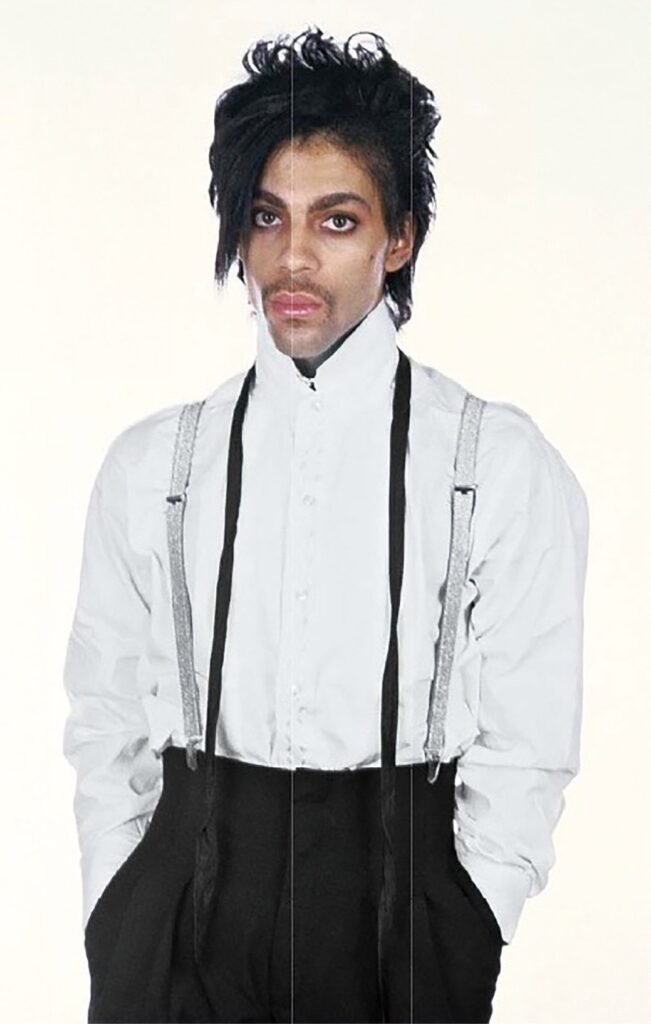

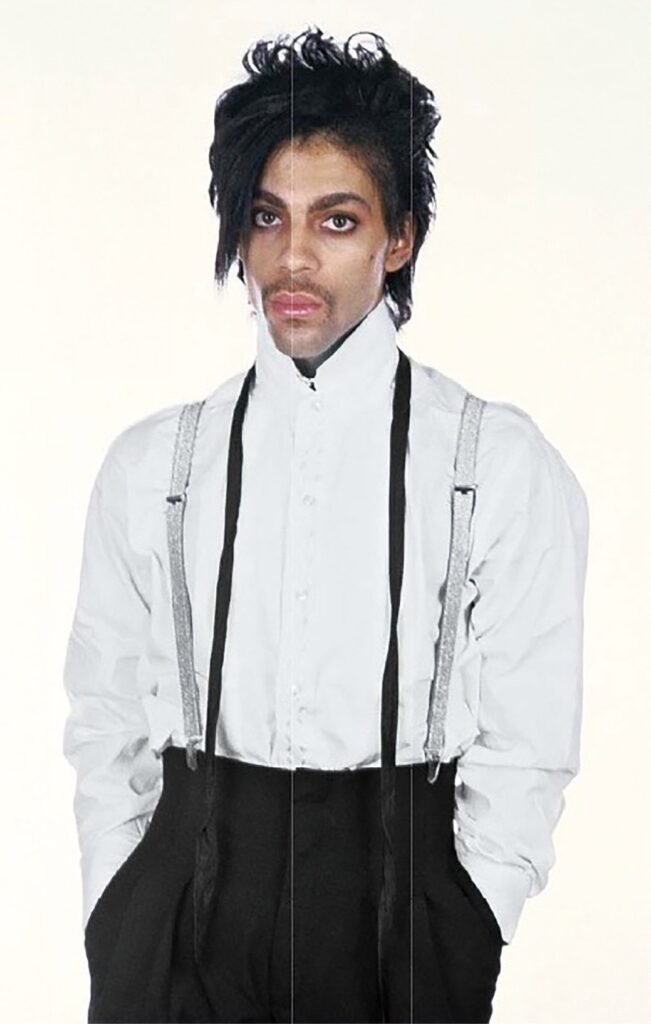

Some background: In 1981, Newsweek hired Lynn Goldsmith, a photographer famous for her album covers and work with rock stars, to photograph the up-and-coming R&B artist Prince. Goldsmith kept this unused outtake for future licensing:

By 1984 Prince was a megastar and Goldsmith licensed the photo to Vanity Fair. This license allowed the magazine to hire an artist to create an illustration based on the photo for a feature story. Vanity Fair paid Goldsmith $400 and commissioned Andy Warhol to make the art.

Working from the photo, Warhol created 16 silkscreens, which he copyrighted. Vanity Fair used one for its article. The entire collection became famous in the art world as the Prince Series, and was sold and reproduced for hundreds of millions of dollars.

When Prince died, Condé Nast, which publishes Vanity Fair, paid the Warhol Foundation $10,250 to run one of Warhol’s Prince images on the cover of a tribute issue. The magazine neither credited nor paid Goldsmith.

At that point, Goldsmith learned of the Prince Series and told the Andy Warhol Foundation that the series infringed on her copyright in the photo. The Foundation countered that Warhol had merely used her image of Prince as a building block to create something new: he cropped and resized the original image, changed the tone, lighting and detail, and added colors, shading and outlines over it. The result, according to the Foundation, was a new work that “comments on the manner in which society encounters and consumes celebrity.” The Foundation sued Goldsmith for a declaration of non-infringement or, alternatively, a declaration that the Prince Series constituted fair use. Goldsmith countersued for copyright infringement.

The Federal District Court in Manhattan ruled in favor of the Foundation. It found the Prince Series “transformative” because it communicated a message different from Goldsmith’s original photograph. Thus, according to the District Court, Warhol’s use of Goldsmith’s photo was fair use.

Goldsmith appealed to the Second Circuit which, in August 2021, reversed and found that the Prince Series was “substantially similar” to her original photograph and did not constitute fair use.

In reaching this decision, the Second Circuit reviewed each of the four factors considered in a fair use analysis: the purpose and character of the secondary use; the nature of the copyrighted work; the amount and substantiality of the secondary use; and the impact of the second work on the market for the origins.

The Second Circuit found that the Prince Series was not fair use because both the original photo and the Prince Series share the same purpose — they are both visual art. Moreover, in the Second Circuit’s view, the Prince Series isn’t fair use because it doesn’t obviously comment on or use the original for a different purpose. Rather, the Prince Series merely recast the original work with a new aesthetic.

It also was clearly troubled by the fact that the Prince Series negatively impacted the market for Goldsmith’s original photo and the possible consequences of people avoiding paying artists’ licensing fees by creating stylized derivative images.

As much as the Second Circuit examined how the two works are reasonably perceived, did the fact that Warhol isn’t around to explain his thinking impact the court’s thinking? Maybe, but should this matter?

Perhaps more centrally, how do you figure out what’s a new aesthetic and what’s not? Or, how much of a new aesthetic is necessary to distinguish a work as new?

These are very hard questions to answer and the Supreme Court pushed the parties’ attorneys — especially the Foundation’s attorney — on where to draw the line.

More on how we got here in the next post.

March 7, 2023

Not all attorneys do the same things. One of the most significant distinctions is between litigators — attorneys who handle disputes, particularly in court or arbitration — and non-litigators.

Here are some tips for the non-litigator (or non-lawyer) to think about if you see a dispute brewing:

- Is there anything you have to do before filing litigation or arbitration? For example, if there’s a contract governing the parties relationship, does your client have to give notice of the dispute? Is there a clause requiring the parties to try to mediate their dispute before proceeding to litigation or arbitration?

- What documents are likely to be relevant to the dispute and what document retention policies are in place? If employees or consultants are using outside devices or channels (they shouldn’t be), you need to make sure that no documents or information go missing.

- Where would a case be brought? If there’s a contract, does it have anything to say about this?

- What is your clients’ internal position and what’s their external position? DO NOT communicate the internal position to the opposition! This is one of the biggest problems I encounter. In discussions with the other side, while it’s important to say enough so that they know you’re serious and understand the basis for your argument, you don’t have to tell them everything. If you’re ever in doubt as to whether to say something, the best policy is always to keep mum and listen.

- Who is speaking for the client and is the message consistent? It’s not helpful to have your lawyer saying one thing and the CEO saying something else.

- Generally speaking, what are your client’s potential claims or the potential claims against your client?

- Is there anyone else involved or who needs to be notified? Is there a third party that might have played a role? Is an insurance company involved?

- Don’t set deadlines or draw lines in the sand if you don’t mean it.

Aligning on these issues can help a client (or, for non-lawyers, your business) save time and money by either avoiding litigation altogether or ensuring that arguments are properly prepared for litigation if it happens.

February 21, 2023

Following up on an earlier blog post, on February 2, 2023, the Court in Hermès’ trademark suit against the artist known as Mason Rothschild issued a decision explaining his denial of both parties’ motions for summary judgment. If you want a refresher about this case, you can find the earlier blog post here.

On February 8, 2023, after an eight-day trial, a federal jury found in favor of Hermès and awarded the fashion company $133,000 in damages. Fundamentally, the jury decided the digital images were not art, not protected by the First Amendment and, as such, subject to trademark laws. This is an important case as it is the first trial to look at trademark infringement and NFTs.

Let’s dig into both decisions.

The Judge’s Order

There are a couple of interesting elements in the judge’s decision.

Hermès argued that Rothschild’s work was devoid of any artistic value because he could at any time replace the digital images of fake fur bags with other images. According to Hermès, this meant the term “MetaBirkins” referred to the NFTs and not the digital images themselves. Judge Jed Rakoff rejected this’ argument, finding that potential consumers believed they were purchasing ownership of the digital image, not just the NFT. Therefore, he concluded that the term “Metabirkin” “should be understood to refer to both the NFT and the digital image with which it is associated.”

Judge Rakoff also (again) concluded that this case was governed by Rogers v. Grimaldi because Metabirkins originated, at least in part, “as a form of artistic expression,” and the fact that Rothschild may have also had commercial motives didn’t remove First Amendment protections.

In rejecting the parties’ motions for summary judgment, the judge held that a jury needed to decide whether Rothschild viewed the Metabirkins project as primarily one of artistic expression or whether, as Hermès, argued, his motives were purely pecuniary and he fabricated the claim of artistic expression in order to seek refuge in the First Amendment.

The judge also noted that the Second Circuit Court of Appeals hadn’t provided a lot of guidance as to what “artistically relevant,” as used in Rogers, means. Despite this, the judge concluded that the central inquiry in determining whether something is “artistic” is whether “the trademark was used to mislead the public about the origin of the product or the parties that endorse or are affiliated with it.” And that, he determined, required a jury to consider the so-called Polaroid factors. He also noted that the likelihood of confusion under these factors must be particularly compelling in order to abrogate First Amendment protection.

The Jury’s Decision

It’s impossible to know exactly why the jury reached its verdict, but looking at the Court’s Instructions of Law to the Jury and the jury’s verdict sheet, an educated guess (at least on the trademark claim) is that the jury concluded there was a likelihood consumers would believe that Rothschild’s MetaBirkins were sponsored or otherwise connected with or approved by Hermès and that Hermès had proved that Rothschild intended to confuse potential consumers.

Interestingly, in instructing the jury on the applicability of Rothschild’s First Amendment defense, the court seemed to assume that Rothschild’s use of the term “Metabirkin” was artistically relevant.

A few other things here: (1) the judge did not instruct the jury that it should look to the Polaroid factors to determine if something was explicitly misleading; (2) the jury instructions dropped any reference to the Polaroid factors from the discussion of whether the MetaBirkin NFTs were explicitly misleading; and (3) the judge seems to have substituted the “explicitly misleading” language from Rogers with an instruction that the jury needed to determine whether “Hermès had prove[n] that Mr. Rothschild actually intended to confuse potential customers” and, if it had, that he had waived his First Amendment protection.

In its verdict, the jury found Rothschild liable for trademark infringement, trademark dilution and “cybersquatting” (using a brand name in bad faith with the intent of making a profit from a trademark belonging to someone else).

We’ll see if Rothschild appeals (he and his lawyers have stated they will) and, if so, whether he raises those issues on appeal.

February 7, 2023

In 2021, the U.S. Court of Appeals for the Third Circuit held in Hepp v. Facebook that Facebook, Reddit, and others were not shielded by section 230 of the Communications Decency Act (“CDA”) from right of privacy and publicity claims brought by Philadelphia news anchor Karen Hepp. In that case, Hepp’s image was used without her permission in ads for a dating service on the social media platform. The Court concluded that, although Defendants might otherwise have immunity from liability under section 230, Plaintiff’s right of publicity claims fell within an exception in the CDA for “intellectual property” claims.

Looking at New York law, a new decision in the Southern District of New York has reached the opposite conclusion.

The recent case — Ratermann v. Pierre Fabre USA, Inc., et al., No. 22 Civ. 325 (S.D.N.Y.) — was brought by model Patty Ratermann. She granted a license to her image to video marketing company QuickFrame, Inc. This license limited the use of her image to Instagram.

QuickFrame licensed her image to Pierre Fabre, the company behind the skincare brand Avène. Despite the fact that the license provided that Ratermann’s image could only be used on Instagram, Raterman discovered it was being used to promote Avène products on Pierre Fabre’s website, as well as on the websites of Amazon, Walmart, and Ulta.

Ratermann sued, claiming, among other things, that these advertisements exceeded the scope of QuickFrame’s license and violated her rights under New York Civil Rights Law sections 50 and 51.

These sections codify New York’s law on the right of publicity. They protect against the unauthorized exploitation of personal traits for advertising. More specifically, section 50 makes it a misdemeanor for a person or corporation to use “for advertising purposes, or for the purposes of trade, the name, portrait or picture of any living person without having first obtained the written consent of such person” and section 51 provides civil remedies for violations of section 50.

The Defendants moved to dismiss with Amazon, Walmart, and Ulta claiming immunity under section 230 of the CDA, which protects a provider or user of an “interactive computer service” from being liable for information provided by another. The purpose here is to protect websites that host third-party content from liability, allowing them to function without facing potentially crushing legal liability for the acts of third-parties. In layman’s terms, Amazon, Walmart, and Ulta argued that because Pierre Fabre created the ads with Ratermann’s unlicensed image, under section 230 they were not responsible for the content.

In response, Ratermann argued her claims under sections 50 and 51 fell within the exception for “intellectual property” relied on by the Third Circuit in Hepp. The Southern District of New York rejected Ratermann’s argument that sections 50 and 51 provide trademark-like protection. Instead, it concluded that these sections protect privacy, not property. Based on this, the Court dismissed Plaintiff’s claims against Amazon, Walmart, and Ulta.

While this conclusion certainly lines up with the purpose of section 230, there are some problems with the Court’s logic.

For starters, if, as the Court concluded, Plaintiff’s claims under N.Y. Civil Rights Law sections 50 and 51 are purely intended to enable people to protect their privacy from unwanted intrusion, why did the New York State Legislature recently extend the protections of these sections to dead people who presumably don’t have any interest in privacy?

Moreover, there is certainly an element of intellectual property protection to claims under sections 50 and 51. Just like copyright, trademark or patent law, claims under these sections are intended to prevent third-parties from cashing in or taking the value associated with a person’s name or image. Consistent with that, Plaintiff — a model — is seeking to recover her losses or defendants’ profits associated with the unauthorized use of her image. She’s not suing because someone grabbed an unflattering picture of her with a long lens. The Court, however, brushed away these concerns by claiming that such rights exist only in the common law right of publicity (which New York does not recognize).

While Ratermann’s team is considering an appeal in the matter against the online retailers, their breach of contract claim against QuickFrame and right of publicity claims against Pierre Fabre continue to move forward.

January 24, 2023

In November, we wrote about the Hermès International vs. Rothschild “MetaBirkin” NFT lawsuit which, among other things, involves questions about whether an artist’s use of trademarks is protected under the Rogers vs. Grimaldi test for trademark infringement. Another case involving NFTs now raises some of the same issues, but with numerous interesting elements all its own.

Yuga Labs launched the Bored Ape Yacht Club (BAYC) NFTs in 2021. This project consists of 10,000 images of — you guessed it — bored apes generated by an algorithm. Sales of the NFTs in this project total more than $1 billion, making it one of the most financially successful NFT projects to date.

But, while BAYC NFTs became hot commodities among celebrities and wealthy collectors, Ryder Ripps, a conceptual artist, interpreted the BAYC’s logo and elements of the ape images as promoting racist stereotypes and incorporating Nazi and neo-Nazi imagery and ideas. In Ripp’s view, Yuga is trying to infiltrate mainstream society with toxic imagery through superficially harmless cartoon art. For example, Ripps noted: similarities between the BAYC and the Waffen SS logos; the ape skull on the Yuga Labs logo has 18 teeth and 18 is code for Adolf Hitler; and the expression “surf the Kali Yuga” is used by white supremacists.

He published these opinions online and, last May, launched an NFT collection called RR/BAYC.

The RR/BAYC NFTs link their own crypto tokens to the BAYC images and sell for about $200 each. According to Ripps’ website, the project “uses satire and appropriation to protest and educate people regarding The Bored Ape Yacht Club and the framework of NFTs.”

Unsurprisingly, especially because of the value of the original BAYC NFTs, in late-June 2022, Yuga Labs sued Ryder Ripps and others involved with RR/BAYC. Yuga Lab’s Complaint alleges false advertising, trademark infringement, and cybersquatting, among other things. According to Yuga Labs, the RR/BAYC “is a deliberate effort to harm Yuga Labs at the expense of consumers by sowing confusion about whether these RR/BAYC NFTs are in some way sponsored, affiliated, or connected to Yuga Labs’ official Bored Ape Yacht Club.”

Notably, despite elsewhere claiming that RR/BAYC NFTs infringed Yuga Lab’s copyrights, the Complaint does not include a claim for copyright infringement. Nor does it include a claim for defamation against Ripps and others involved with RR/BAYC.

Ripps and the other defendants in the lawsuit moved to dismiss the Complaint. They argue RR/BAYC is an expressive artistic work protected by the First Amendment and, therefore, not actionable under Rogers. They also claim that Yuga Lab’s Complaint must be dismissed because RR/BAYC buyers “understood that their NFT was being minted as a test against and parody of BAYC, and no one was under the impression that the BAYC NFTs were substitutes for BAYC NFTs or would grant them access to Yuga’s club. They explicitly acknowledged a disclaimer when they purchased [the NFTs].” Ripps also filed an anti-SLAPP motion, claiming Yuga Labs is trying to silence him through its lawsuit.

In December, the Court denied defendants’ motions. It held Rogers did not apply as the RR/BAYC NFTs did not “express an idea or point of view, but, instead, merely ‘point to the same online digital images associated with the BAYC collection.’” It also concluded defendants’ use of Yuga’s marks isn’t nominative fair use because defendants are using the marks to sell their own NFTs, not plaintiff’s NFTs.

As for the anti-SLAPP motion, Judge Walter wrote, Yuga Labs had “not brought claims against Defendants for defamation, slander, or libel. Instead, Plaintiff’s claims are limited to and arise out of Defendant’s unauthorized use of the BAYC Marks for commercial purposes.”

And that’s what’s so interesting here: Yuga sued solely for trademark infringement and not for defamation or copyright infringement. Why? On defamation, maybe to prevent anyone from looking too deeply at whether Yuga Labs’ imagery is, in fact, racist or relies on white supremacist imagery and ideas. However, this strategy seems to have backfired as the Court recently required the founders of Yuga Lab to sit for a deposition. Presumably, defendants’ lawyers used this opportunity to specifically address this issue.

On copyright, it seems likely that Yuga Labs didn’t bring a claim because any copyrights belong to the NFT purchasers, not Yuga. Yuga may have also avoided bringing a copyright claim to skirt the issue of whether algorithm-generated NFT collections like BAYC are sufficiently original to qualify for copyright protection.

In any event, stay tuned. If the parties don’t settle, this case will likely go to trial later this year.

January 10, 2023

Among the most frequent — and sensitive — disputes in business are those between co-founders or co-owners of a company. These conflicts come in all shapes and sizes, but some types are most prevalent. Because they can be so contentious and emotionally charged, it’s best to handle them carefully and quickly before they fester and cause irreversible damage. Here are the ones we’ve seen the most, along with a few paths parties can take to resolve disputes and prevent worst-case scenarios.

Different Perceptions, Divergent Goals

Credit and recognition can be key drivers of conflict: When junior owners of an organization feel like their recent contributions aren’t being recognized or, conversely, when senior owners feel they’re not being given their due for past efforts that grew the business into what it is today. In other conflict scenarios, a senior owner wants to keep the business on its traditional course while a junior owner is anxious to expand into new areas. Also common are situations when a senior owner is moving toward retirement, but can’t let go of his or her baby and hand over responsibility to junior owners.

Attorneys are a great resource for co-founders and co-owners for help in these situations, but there are other options business owners can turn to in addition. Mediators work with conflicting parties to lay out different means of resolving disputes while evaluating the advantages and disadvantages of each. Business coaches can suggest new methods for the owners to execute their roles, or facilitate difficult discussions around the issues at hand and identify ones that haven’t yet been addressed. Similarly, an external business consultant might be able to help balance divergent goals, discover unseen opportunities or chart a new course for a business that everyone can align on.

Expenses: Business or Personal?

Small business owners often blur the line between business and personal expenses — dining out, gym memberships, travel, etc. — and this can cause conflict when two or more partners are involved. It quickly becomes a problem when co-owners or co-founders have different ideas about what is or isn’t an appropriate use of the company credit card, or if one partner feels another is abusing it or simply deriving more benefit than him or herself.

In these cases, an accountant may be able to help explain what is considered appropriate use of corporate funds, determine how co-owners use them when the expense is questionable and install mechanisms to be sure no one is taking advantage.

Unequal Effort

One of the most common causes of dispute: when one founder or owner, rightly or wrongly, feels like another founder or owner isn’t doing his or her fair share of the work.

When one partner believes they are doing more work than the other, recognize that things shift over time and while you may be carrying more of the load today, the situation may be reversed in a few months. Time is a great leveler.

Substance Use

A leading cause of someone not pulling their weight, this becomes a serious concern when a co-founder or co-owner is unable to productively participate in the operation of the business due to their substance use.

When this is the problem, it may be most effective to first consult a doctor or other medical professional, while also considering mediation or a business coach.

Overall, if you are a co-owner or co-founder involved in a dispute with your partner(s), the key is to talk to them, listen and try not to judge. In many cases like those described above, the issues are not new: they’ve been present in the business for a while, the co-owners or co-founders have discussed them repeatedly and feel like they’ve had the same conversation over and over again without getting anywhere.

That’s frustrating, and frustration leads to resentment and, many times, anger and rash decision making. Early intervention is key to try and resolve the issues before too much resentment builds. And wherever you are in the process, sometimes taking a step back and thinking about what is really motivating the other party, or why they believe what they believe, can provide fresh insight and help break a deadlock.

December 13, 2022

Every time we post personal data on a social media platform, we’re making information about ourselves public. But really, what seems like public property that anyone can access, in fact, sometimes becomes someone else’s private property — as an interesting, ongoing case about who controls such data illustrates.

hiQ is a self-styled “people analytics” company. Its business model involves scraping LinkedIn users’ public profiles, analyzing the data with a proprietary algorithm, and selling the results to employers looking to retain and train employees.

Unfortunately for hiQ, such data scraping is prohibited by LinkedIn’s User Agreement.

In May 2017, LinkedIn sent hiQ a cease and desist letter. It cited the violation of its User Agreement and demanded that hiQ stop its use of LinkedIn users’ public profile data. In response, hiQ filed suit in the Northern District of California and sought an injunction barring LinkedIn from claiming that hiQ was violating the Computer Fraud and Abuse Act (CFAA), the Digital Millennium Copyright Act, and California law.

The District Court granted hiQ’s injunction in August 2017.

In reaching this conclusion, the District Court held that hiQ’s interest in the survival of its business, which was threatened by LinkedIn’s demand that it cease and desist from scraping public LinkedIn data, was greater than LinkedIn’s interest in protecting the public profiles of its users. The Court also held that the public interest favored hiQ because LinkedIn was, in effect, seeking to eliminate hiQ as a competitor and establish a monopoly. (At the time it sent the cease and desist, LinkedIn was exploring providing services similar to hiQ’s.)

LinkedIn appealed the injunction to the 9th Circuit, which affirmed the lower court’s ruling in favor of hiQ. LinkedIn next appealed to the U.S. Supreme Court, which vacated the 9th Circuit’s ruling and remanded the case. In April 2022, the 9th Circuit again affirmed the District Court’s preliminary injunction in favor of hiQ.

While the issue of the injunction went to the 9th Circuit (twice) and SCOTUS (once), the parties were busy conducting discovery. At the end of discovery, each party filed a motion for summary judgment and the District Court ruled on these motions in November.

On the whole, despite winning the initial battle over the injunction and the fact that it did score a few wins at the summary judgment stage, it’s safe to say that hiQ definitely came out on the losing end of things. In large part this is because LinkedIn’s cease and desist seems to have quite a chilling effect; it caused hiQ to lose funding and employees.

hiQ’s losses didn’t end there. The District Court found that hiQ agreed to the terms of LinkedIn’s User Agreement, when it ran ads and created accounts on LinkedIn and, contrary to hiQ’s position, the User Agreement unambiguously bars scraping.

However, the Court did allow hiQ to proceed to trial on the issue of whether LinkedIn’s claims under the CFAA are barred by a two-year statute of limitation because there was evidence that LinkedIn employees were aware of hiQ’s activities for more than two years before it filed suit in 2017. At trial, a jury will have to determine if these employees’ knowledge can be imputed to LinkedIn.

Despite hiQ being allowed to proceed to trial, overall LinkedIn came out ahead because, regardless of the outcome of this case, it effectively seems to have not only disposed of any competition from hiQ, but also effectively limited the ability of other entities that might try to monetize information that we, the public, freely provide to LinkedIn.

November 29, 2022

Some people relish a fight. Most, however, don’t — especially when the conflict results in litigation. This is especially true for business owners because litigation costs money, takes time and attention away from running the business, and can be emotionally exhausting. If you do find yourself in litigation, what should you do? Here are 10 techniques for resolving disputes.

- Recognize that most disputes are resolved by the parties before a trial. While reliable statistics are almost impossible to come by, it’s a fact that most disputes do get resolved without a trial. Remember that and take heart: no matter how bad things seem at first or how unpleasant the process may become, the odds are overwhelmingly in favor of a pre-trial resolution.

- Acknowledge your feelings. Anger, despair, and frustration are just a few of the emotions likely to arise during a dispute. Rather than try to hide from this discomfort, recognize the feelings as they occur, talk about them with people you trust, and work to use them, or get to a place where these feelings aren’t ruling the day.

- Know yourself and the other side. When a dispute arises, spend some time thinking about what’s motivating everyone involved. Often it just comes down to money, but in many cases, there’s more lurking beneath the surface. What is really driving you? What do you think they want? Justice? Revenge? Admission of responsibility? Determine what those motives may be for both sides. It will be a huge help defining a path to resolution.

- Problem solve. Now that you’ve identified the motives underlying the dispute, spend some time thinking about possible resolutions to both the spoken and unspoken issues. Don’t just do this for yourself: imagine resolutions that would satisfy you and the other side too.

- Think about what’s really important. When imagining a resolution, identifying and ranking priorities can clarify what’s most important to you (and what’s not). This can also help you find solutions you may have overlooked.

- Envision different solutions. Make a list of potential outcomes and think about the impact each will have on your business in three months, six months and a year.

- Talk. Communication with the other party in a dispute is critical, and in today’s world of email and text nuance is often lost. What’s more, a lot of people find it easier to be a jerk by email or text than in person. Avoid this by insisting on in-person or virtual meetings where you can communicate face-to-face.

- Sometimes skilled third-parties can help you get to a resolution. Lawyers who handle a lot of disputes have seen it all before (really!) and may have fresh ideas and different perspectives that can help bring about the best possible outcome. Similarly, skilled mediators are experts at resolving disputes, often by working with the parties to identify the risks and costs of continued conflict and eventual litigation.

- A good resolution usually means everyone is unhappy. It’s a maxim you’ll hear from lawyers and you know why? Because it’s true. Compromise is generally unwelcome but it’s at the core of any dispute resolution, and compromise inevitably means that everyone has to give up something they’d rather not. But people usually find that once all is said and done, the compromise was worth it.

- Focus on the future, not the past. Try to forget what happened to cause the dispute and focus on what’s in front of you. Put aside thoughts of who is to blame. What’s past is past, and you’re not going to be able to change it. That doesn’t mean you shouldn’t fight for what’s right or the best possible outcome. Just don’t let feelings about what happened in the past prevent you from attaining a resolution in the present that you’ll realize, in the future, was a satisfactory outcome.